Find depreciation rate calculator

Calculate your fixed asset depreciation rateeffective life. Use this calculator specifically to calculate depreciation of residential rental or nonresidential real property related to IRS form 4562 lines 19 and 20.

Car Depreciation Calculator

To use the calculator simply enter the purchase price of the car and the age at which the car was when it was purchased by you 0 for brand new 1 for 1-year old etc.

. The depreciation rate is the annual depreciation amount total depreciable cost. 7 6 5 4 3 2 1 28. There are many variables which can affect an items life expectancy that should be taken into consideration.

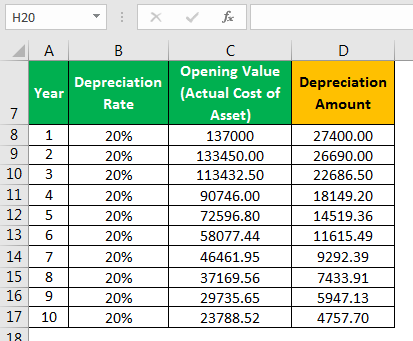

When an asset loses value by an annual percentage it is known as Declining Balance Depreciation. Calculate depreciation for a business asset using either the diminishing value. The depreciation of an asset is spread evenly across the life.

The first step to figuring out the depreciation rate is to add up all the digits in the number seven. Next youll divide each years digit by the sum. Finds the daily monthly yearly and total appreciation or depreciation rates based on starting and.

A calculator to quickly and easily determine the appreciation or depreciation of an asset. Enter the purchase price of a business asset the likely sales price and how long you will use the asset to compute the annual rate of depreciation of that asset or piece of equipment. The calculator should be used as a general guide only.

Percentage Declining Balance Depreciation Calculator. Basic Tax Depreciation Overview Including Depreciation Methods Accounting Procedures. Find the depreciation rate for a business asset.

Car Depreciation Calculator. Reduce Your Income Taxes - Request Your Free Quote - Call Today. A depreciation factor of 200 of straight line depreciation or 2 is most commonly called the.

In other words the. D i C R i. In this case the machine has a straight-line depreciation rate of 16000 80000 20.

Where Di is the depreciation in year i. The car depreciation calculator allows you to find the market value of your car after a few years. Depreciation rate finder and calculator.

Select the currency from the drop-down list optional Enter the. Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started. Non-ACRS Rules Introduces Basic Concepts of Depreciation.

You can use this tool to. C is the original purchase price or basis of an asset. It is fairly simple to use.

If you leave the. The MACRS Depreciation Calculator uses the following basic formula. This unique AssetAccountant search tool allows you to search fixed assets to determine the appropriate fixed asset depreciation.

The calculator also estimates the first year and the total vehicle depreciation. Ad Get A Free No Obligation Cost Segregation Analysis Today. Build Your Future With a Firm that has 85 Years of Investment Experience.

For example if you have an asset. We will even custom tailor the results based upon just a few of. Reduce Your Income Taxes - Request Your Free Quote - Call Today.

It assumes MM mid month convention and. Ad Get A Free No Obligation Cost Segregation Analysis Today. The straight line calculation as the name suggests is a straight line drop in asset value.

Our Car Depreciation Calculator below will allow you to see the expected resale value of over 300 models for the next decade. All you need to do is. Given 2 exchange rates in terms of a Base Currency and a Quote Currency we can calculate appreciation and depreciation between them.

Use this calculator to calculate an accelerated depreciation of an asset for a specified period. Calculating Currency Appreciation or Depreciation.

Depreciation Formula Calculate Depreciation Expense

Depreciation Calculator

Double Declining Balance Depreciation Calculator

Depreciation Formula Calculate Depreciation Expense

Free Macrs Depreciation Calculator For Excel

Depreciation Calculation

Annual Depreciation Of A New Car Find The Future Value Youtube

Straight Line Depreciation Formula And Excel Calculator

Depreciation Rate Formula Examples How To Calculate

4 Ways To Calculate Depreciation On Fixed Assets Wikihow Fixed Asset Asset Calculator

Reducing Balance Depreciation Calculator Double Entry Bookkeeping

Depreciation Calculator

Depreciation Formula Calculate Depreciation Expense

Depreciation Formula Examples With Excel Template

Depreciation Rate Formula Examples How To Calculate

4 Ways To Calculate Depreciation On Fixed Assets Wikihow Fixed Asset Economics Lessons Small Business Bookkeeping

Depreciation Rate Formula Examples How To Calculate